In recent years, Electronics manufacturers all over the world are pivoting towards Vietnam to manufacture their products. For instance, Xiaomi Corp announced that it had started producing smartphones in Vietnam as part of an effort to expand its regional presence. Samsung Electronics’ smartphone manufacturing contributed USD 57.5 billion to the country’s exports in 2021.

Interested in setting up a plant in Vietnam? Find out about our Business Setup Services to help you get started right away!

Growth of the electronics industry in Vietnam

Current trends in the Electronics Manufacturing Sector

For 2021, the electronics sector clocked USD 116 billion in exports, according to the General Statistics Office.

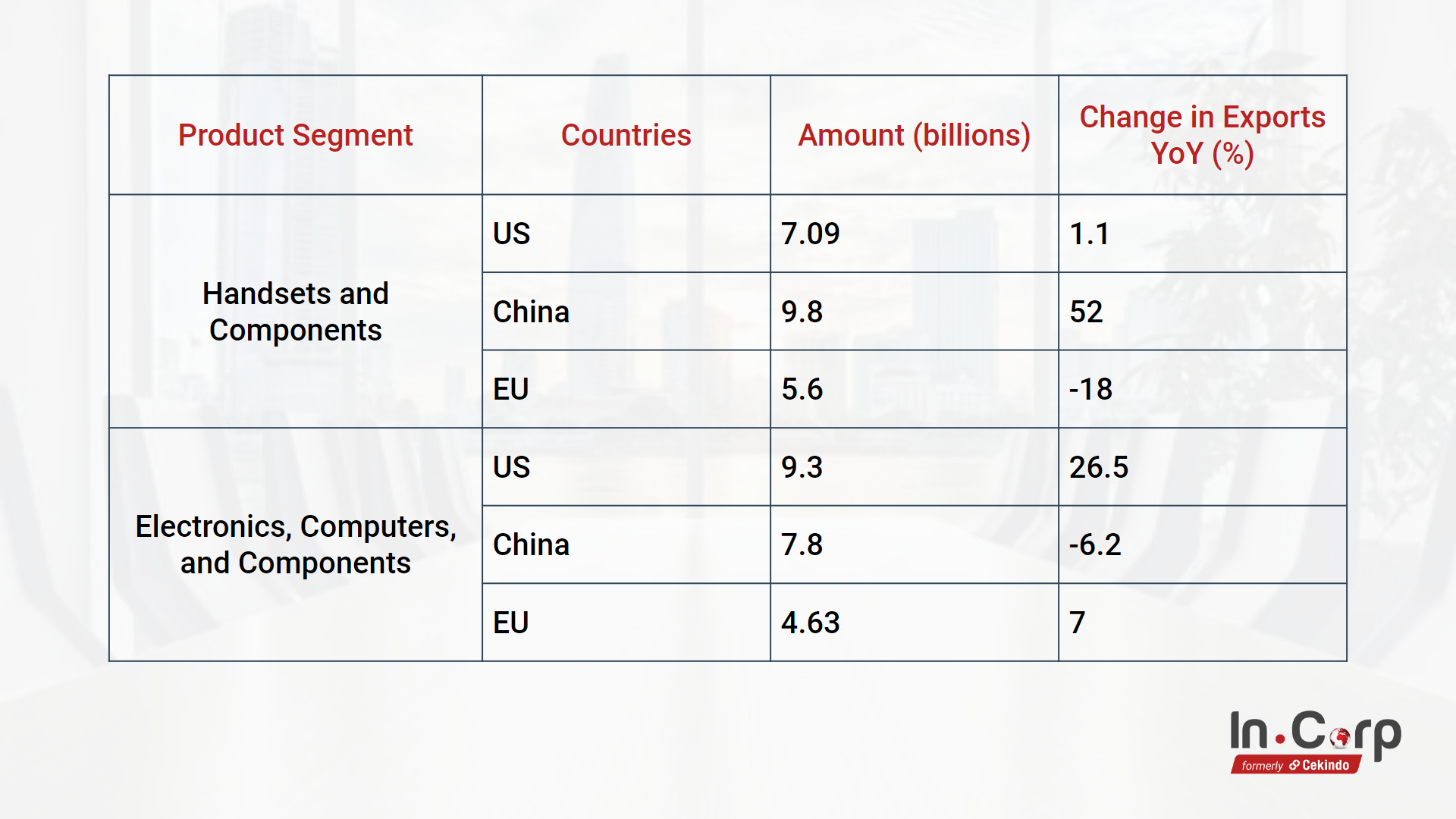

A total of USD 57.5 billion was exported as Handsets and Components, while Electronics, Computers, and Components accounted for USD 50.8 billion, surging 11.5% and 13.6% over the previous year, respectively.

Share of electronics exports to main geographies

Manufacturers who have joined the trend

Many of the world’s largest technology companies have set up factories in Vietnam, such as Samsung, Foxconn, Canon, LG, and Intel.

- Samsung: District 9, Ho Chi Minh City; Yen Phong, Bac Ninh; Pho Yen, Thai Nguyen.

- Foxconn: Tu Son and Que Vo, Bac Ninh; Viet Yen, Bac Giang; Yen Hung, Quang Ninh.

- Canon: Dong Anh, Ha Noi; Que Vo, Bac Ninh; Tien Du, Bac Ninh.

- LG: Trang Due, Hai Phong

- Intel: District 9, Ho Chi Minh City

In the past few months, Lenovo has visited Bac Ninh and Bac Giang to explore the possibility of building factories in Vietnam. Moreover, Apple’s primary partners are increasing manufacturing activity in the country, including Luxshare, Wistron, Pegatron, and Foxconn.

- Luxshare: Viet Yen, Bac Giang

- Wistron: Dong Van, Ha Nam

- Pegatron: Hai An, Hai Phong

Foxconn recently announced it was investing USD 270 million in Bac Giang to produce iPads and MacBooks for Apple. Within the next three to five years, the company plans to invest USD 40 billion in Vietnam.

Major tech giants have made major contributions to the development of the country’s electronics industry (EI). A significant portion of Vietnam’s EI’s value is sourced from foreign direct investment (FDI), making it the 12th largest electronic exporter in the world.

The move of electronics manufacturers from China to Vietnam

Vietnam is growing as a manufacturing investment destination in Southeast Asia thanks to its favorable labor force, political stability, and impressive GDP growth rate.

Insights on Vietnam’s various parameters and respective growth

| Labor Force | 57.4 million (59% of the population) |

| Real GDP Growth | +7% p.a. (2014-2019) |

| Political Risks | 70.4 (2019) (100=Most Stable) |

| Corruption Index | 36 (2019) (100=Most Transparent) |

| Ease of Doing Business Index | 70 (2019) (1= Most Stable) |

| Competitiveness Index | 61.5/100 (2019) |

RELATED: Shifting your contract manufacturing from Vietnam to China

Why are manufacturers choosing Vietnam?

Tax incentives as of 2022

Corporate Income tax (CIT) rate of 10% shall be applicable for 15 years to foreign-invested companies (FICs) with various socio-economic conditions as listed in the following:

- Appendix issued with Decree No.124/2008/ND-CP

- Economic zones and High-Tech zones

- Businesses that are into the following domains:

- Scientific research and technological development;

- Computer software-related products; and

- Investment in the development of water plants, power plants, and other infrastructure development approved by the Government;

Current relocation projects

Companies already moving productions from China:

- Inventec

- TCL

- Wistron

- Pegatron

- Apple

Companies planning to move productions from China:

- Qisda

- Microsoft

- Lenovo

- Nintendo

Not sure how to start expanding your business to Vietnam? Read our latest Vietnam Business Setup Guide, now available as an interactive checklist!

Challenges for Electronic Manufacturers in Vietnam

- Lack of Electronics Industry clusters

An economic cluster comprises suppliers, infrastructure, and research institutes that offer intermediate products and specialized services in a particular area. In industrial provinces (e.g., Ho Chi Minh City, Hanoi, and Haiphong), EI clusters are in their initial stages of inception.

Cluster location ensures enterprises and organizations can deliver products and services at cheaper rates without compromising the timelines.

As a result, the business can generate qualified labor and goods, which further leads to the transfer of knowledge and expertise. Moreover, the parties can work cohesively and promote competitive advantages.

- Reliance on foreign technologies

The Mobiistar Prime X-Max (Mobiistar Company) and the Bphone (Bkav Technology Group) were among the Vietnamese smartphones that established their presence in the market between 2015 and 2016. After operating for a few months, both companies terminated their activities.

Here are a few reasons for their failure:

i) There was immense competition from companies with a high market share, such as Nokia, Samsung, LG, Apple, etc.

(ii) A weak infrastructure and a lack of knowledge of consumers’ needs on the Vietnamese side;

(iii) and complete dependency on imports of essential components and software.

- The issue of quality of labor resources

According to a study conducted by the Ministry of Labor, Disabled and Social Affairs and the GSO during the 2nd quarter of 2018, Vietnam had a working population of 55.12 million. Of these, only 22% have had vocational education with certificates and have received different levels of training. Educational organizations are generally understaffed. As a result, the onboarding of junior staff has become a strenuous task.

Generating highly skilled labor through vocational training could help increase productivity and competitiveness at the national level.

RELATED: How to Set Up an Electronics Manufacturing Company in Vietnam

Opportunities for Electronics Manufacturers

Thanks to Vietnam’s open economy and active involvement in international organizations, its internal resources are fully utilized, representing clear opportunities for investors. As far as reducing tariffs on electronic goods is concerned, the country has achieved significant results since 2006. There have been many free trade agreements negotiated recently in Vietnam, such as the Trans-Pacific Partnership (TPP) and the European Union Vietnam Free Trade Agreement (EVFTA). These agreements provide favorable conditions for electronics manufacturers to expand regionally and internationally.

In export industries, the electronics sector has always commanded the leader’s position since 2013. Moreover, the Vietnamese economy is growing positively, and the political system is stable in the country.

Labor costs in developing countries such as Vietnam are already low. Since Vietnam joined the WTO in 2006, its tax rates for electrical components and raw materials have improved.

According to ToQuoc.vn, FDI companies make up USD 56.9 billion, around 99% of Vietnam’s electronics exports in 2021. Large corporations like Samsung, Foxconn, LG, Panasonic, Intel, Electronics, and Nokia provide a large portion of this capital.

Conclusion

Besides being the fastest-growing economy in the Southeast Asian region, Vietnam also occupies a crucial geopolitical location, thanks to its proximity to China. As a result of the ongoing China-US trade conflict, several EU companies are pivoting toward Vietnam as their manufacturing site.

About Us

Cekindo is a leading provider of global market entry services in South East Asia. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia, headquartered in Singapore. With over 500 legal experts serving over 12,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.