In November 2022, Tan Cang Hai Phong International Container Terminal (Hai Phong) marked a significant milestone by welcoming its one-millionth TEU (twenty-foot equivalent unit). This event showcased the growth of deep-water ports in Hai Phong and testified to the terminal’s credibility. Moreover, the direct shipping of goods from Vietnam to Western countries is expected to lower logistics costs and bolster the trust of foreign investors interested in establishing factories in Hai Phong and other northern regions.

Interested in importing to and exporting from Vietnam? Check out our hassle-free one-stop business setup services!

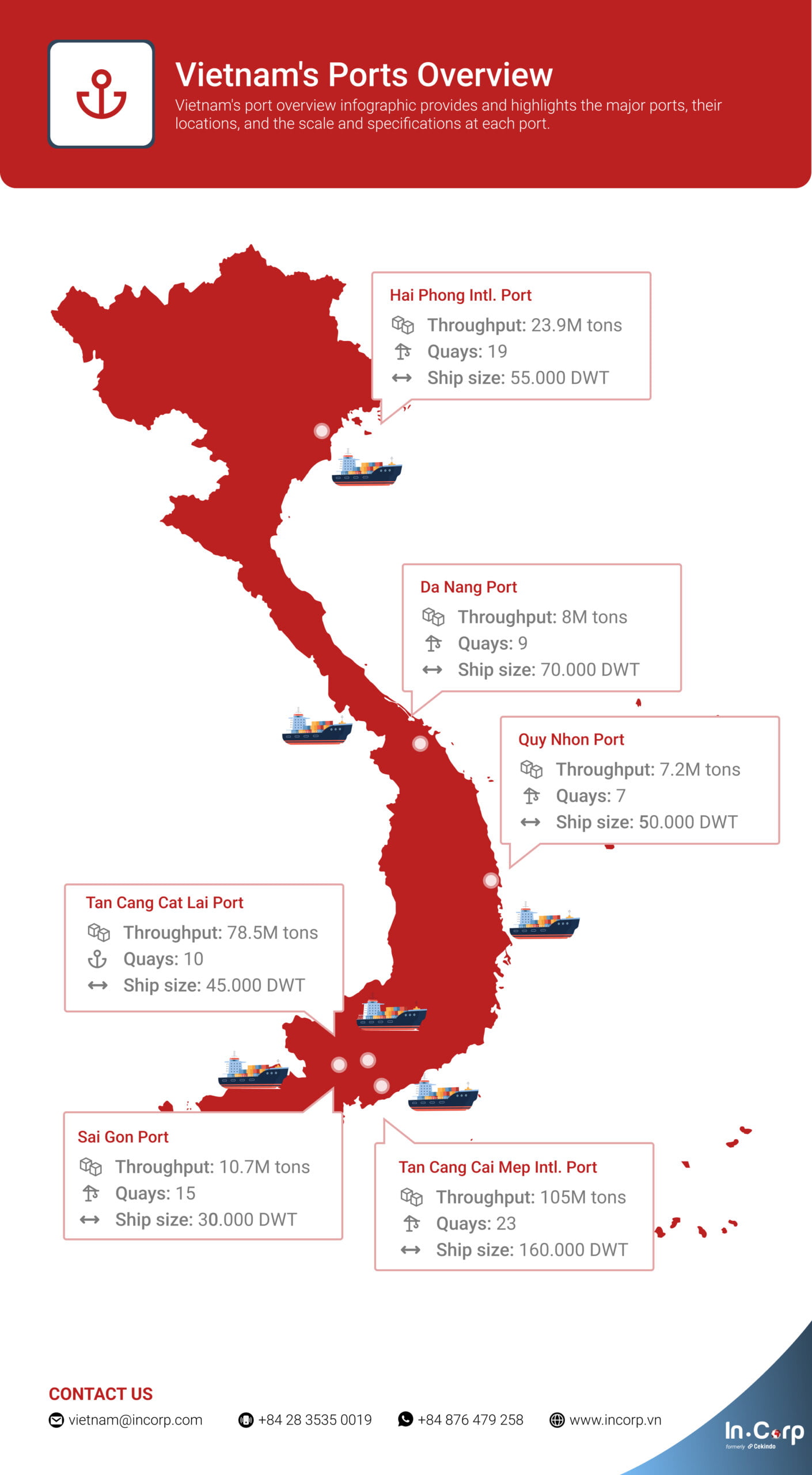

Vietnam’s network of seaports represents immense diversity and potential for international trade, imports, exports, and overall economic growth. Vietnam’s sea area spans over 1 million square kilometers, with close to 50 ports currently in use, two of which are international ports (Cai Mep International Terminal and Hai Phong International Terminal).

In this article, we will explore the significance of Vietnam’s ports in bolstering the economy and paving the way for global trade.

Vietnam’s Most Important International and Domestic Ports

According to the most recent update by Lloyd Maritime Company (UK), Vietnam has three seaports that are ranked among the top 50 worldwide in cargo throughput. The three ports are Saigon Port (ranked 22nd), Hai Phong Port (ranked 28th), and Cai Mep Port (ranked 32nd).

- In 2021, Saigon Port clocked a throughput of 7.9 million TEUs, registering a growth rate of approximately 1.3% from 2020.

- Cai Mep seaport’s throughput in 2021 was 5.32 million TEUs, with a growth rate of approximately 22% after the pandemic, surpassing most Southeast Asian countries. Cai Mep’s remarkable growth was due to the operation of Gemalink port, in which the world’s largest shipping line CMA-CGM holds a 25% stake.

- In 2021, the Hai Phong port managed 5.69 million TEUs, representing a growth of approximately 10.8% year-on-year. The other seaports of Hai Phong also saw a rise in freight volume, most notably Tan Vu port (Lach Huyen), with a remarkable 1 million TEUs.

The Can Gio international transshipment port project has the potential to become the country’s largest transshipment port. The project has an estimated investment value of USD 6 billion and can substantially impact trade with neighboring countries.

Tan Cang – Cai Mep

Tan Cang-Cai Mep International Terminal Co. Ltd. (TCIT) is a partnership between Saigon Newport Corporation, Taiwan’s Wan Hai Lines, Korea’s Hanjin Transportation, and Japan’s Mitsui O.S.K. Lines.

The terminal commenced activities in 2011, with the aim of providing international standard freight management services to clients. TCIT is highly convenient for the transshipment of cargo to Dong Nai, Ho Chi Minh City (HCMC), Long An, Binh Duong, and vice versa.

TCIT has heavily invested in its terminal facilities, which include a main berth that stretches 890 meters, 3 barge berths measuring 270 meters, and a container yard spanning 55 hectares with a capacity of over 50,000 TEUs. The terminal is also equipped with advanced and eco-friendly equipment, such as STS cranes, e-RTG cranes, and empty container handlers. Moreover, TCIT utilizes innovative technology called the Terminal Operations Package System (TOPS), provided by Realtime Business Solutions.

TCIT is making rapid progress and is expected to transform into a world-class container terminal operator soon. Its primary objective is to deliver highly dependable and competitive services to customers while simultaneously focusing on maintaining safety, and environmental sustainability.

Hai Phong

Hai Phong International Container Terminal (HICT) is a deep-water container terminal located in northern Vietnam that spans 750 meters and has two berths. It features:

- a 14-meter access channel depth

- a 660-meter turning basin

- a berth depth of 16 meters

The port has the capacity to handle vessels of up to 14,000 TEUs, operating on long-haul routes and facilitating cargo throughput of up to 1.1 million TEUs annually.

The port enables Vietnam to trade directly with western countries, thereby reducing the lead time by three to five days. Moreover, it also helps cut logistics expenses and mitigate risks.

Saigon

Saigon Port is a leading port in Vietnam’s maritime industry, with the highest throughput and handling capacity in the country. It has a history of over 150 years and has played a vital role in supporting the economic development of Vietnam.

Saigon Port plays a crucial role in serving the import and export needs and contributing to the economic development of the entire Southern region of Vietnam. With an annual cargo throughput of more than 10 million tons, Saigon Port operates on a large scale and has a significant regional impact.

Saigon Port has received support from both the government and the community in accordance with state policy to create favorable conditions for further development and to maintain its important role in the region and globally.

Danang

Established in 1901 through building and expansion efforts, Da Nang Port has demonstrated its significant contribution to the socio-economic progress of the area and has cemented its status as the biggest harbor in central Vietnam.

Situated within Da Nang Bay, covering an area of 100 square kilometers, and facilitated by a well-established transportation infrastructure, Da Nang Port has emerged as a crucial link in the logistics network of Central Vietnam. Moreover, it serves as the endpoint of the East-West Economic Corridor, connecting Myanmar, Thailand, Laos, and Vietnam, and serves as the primary gateway to the East Sea for the entire region.

The port features almost 1,200 meters of berths, capable of accommodating cargo carriers weighing up to 70,000 deadweight tons (DWT), container ships with a capacity of up to 4,000 TEUs, and passenger vessels weighing up to 170,000 gross register tons (GRT). Moreover, it has contemporary loading and unloading machinery, as well as storage facilities.

RELATED: 3PL and 4PL Companies in Vietnam – Choosing The Right Logistics Outsourcing Solutions

Quy Nhon

Quy Nhon Port is classified as a national focal port of the South Central region of Vietnam. It is located in the Gulf of Quy Nhon, making it easily accessible for vessels to anchor throughout the year. Due to the natural depth of the berths and nautical channels, ships with loads of up to 50,000 DWT can easily enter and exit the port.

Quy Nhon Port serves as the gateway connecting the East Sea to South Central to Tay Nguyen regions, and countries in the Mekong Delta. Its strategic location next to international maritime routes provides convenient access for ships sailing in and out. The port is in a central position for Southeast and East Asia, with over 10 maritime routes connecting to international ports such as Manila, Singapore, Taiwan, Thailand, Japan, and Russia.

The port is renowned for its high productivity, excellent quality, and quick cargo vessel release. It boasts a plethora of modern handling equipment and facilities, making it capable of handling different types of cargo, such as bulk, containers, over-length, and overweight cargoes. The port’s management system adheres to the ISO 900 standards.

Tan Cang – Cat Lai

Over its 34 years of operation, the port has undergone significant development under the management of the Saigon New Port Corporation. It has become a reputable and successful player in the domestic and international maritime economy.

Tan Cang-Cat Lai Port is ranked among the top 20 container port clusters with the highest production globally. Despite facing numerous challenges, the Saigon New Port Corporation managed to achieve a 5.4% increase in revenue and a 16.2% increase in profit last year. In addition, it contributed over 1.9 trillion VND to the State budget.

Every year, around 4.9 million twenty-foot containers are managed in Ho Chi Minh City. That is over 8,000 trucks daily circulating the city to unload or load containers from the port area. More than 92% of this volume is handled by Tan Cang-Cat Lai Terminal, making it accountable for almost half of Vietnam’s total container volume.

Boosting Vietnam’s Logistics Potential with Megaports

Can Gio Port by MSC

The Mediterranean Shipping Co has partnered with Vietnam National Shipping Lines and Saigon Port to develop a transshipment hub in Can Gio, south of HCMC. This project aims to create the country’s biggest box port complex and is being pursued by MSC’s port subsidiary, Terminal Investment Limited (TIL).

The port is expected to have a quayside measuring 7.2 km and would be capable of accommodating the world’s largest container vessels. Once fully operational, the port would receive a yearly throughput of over 10 million twenty-foot equivalent units (TEUs), which would provide additional capacity to Vietnam, where the export of goods is increasing rapidly, and many ports are already running at 100% capacity.

Assuming approval is granted, TIL and its collaborators intend to commence construction of the port in 2024.

Vinh Phuc

A USD 300 million inland container depot (ICD), Vietnam SuperPort, is set to be developed in Vinh Phuc, by YCH Group, a Singaporean logistics firm, and T&T Group, a Vietnamese conglomerate, in collaboration with the International Finance Corporation, the private-sector division of the World Bank. The project aims to address the imbalance between the rise in exports and the lack of investment in inland logistics in Vietnam. The Vietnam SuperPort is scheduled to commence operations in 2024.

YCH recognizes the challenges of Vietnam’s logistics landscape and aims to tackle them with the Vinh Phuc ICD project. The hub aims to be an integrated network of air, sea, rail, and land transport with a standardized infrastructure that nurtures a complete supply chain for suppliers, manufacturers, and consumers.

Conclusion

In recent years, Vietnam has experienced a decline in its logistics market share due to a lack of action from policymakers, despite its favorable location and economic expansion. This resulted in lower competitiveness compared to neighboring countries, according to Agility’s Emerging Markets Logistics Index.

Nevertheless, Vietnam still ranks number ten worldwide and remains an important player in omnichannel expansion and is a significant contributor to the growth of the internet economy. Vietnam’s 2,030-mile coastline offers a strategic advantage for the maritime industry, resulting in a steady 7% annual growth in TEUs.

Vietnam has established itself as a significant participant in the Asia-Pacific (APAC) region, with a 24% year-over-year increase in e-commerce spending. As a beneficiary of the U.S.-China trade war, Vietnam can help manufacturers diversify their supply chain networks and utilize low labor costs for labor-intensive industries.

About Us

InCorp Vietnam is a leading provider of global market entry services. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,100 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.